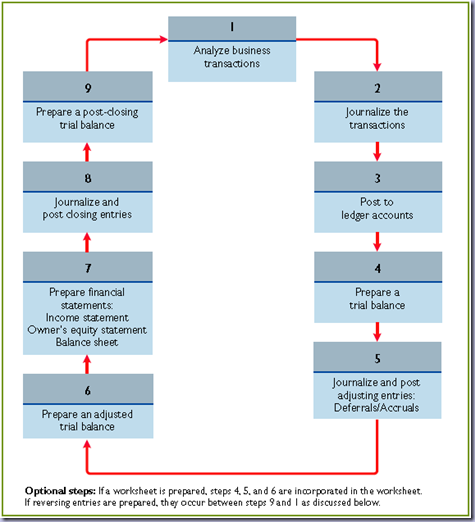

What is Accounting Cycle?

The accounting cycle is often described as a process that includes the following steps: identifying, collecting and analyzing documents and transactions, recording the transactions in journals, posting the journalized amounts to accounts in the general and subsidiary ledgers, preparing an unadjusted trial balance, perhaps preparing a worksheet, determining and recording adjusting entries, preparing an adjusted trial balance, preparing the financial statements, recording and posting closing entries, preparing a post-closing trial balance, and perhaps recording reversing entries.

Cycle and steps seem to be a carryover from the days of manual bookkeeping and accounting when transactions were first written into journals. In a separate step the amounts in the journal were posted to accounts. At the end of each month, the remaining steps had to take place in order to get the monthly, manually-prepared financial statements.

Today, most companies use accounting software that processes many of these steps simultaneously. The speed and accuracy of the software reduces the accountant's need for a worksheet containing the unadjusted trial balance, adjusting entries, and the adjusted trial balance. The accountant can enter the adjusting entries into the software and can obtain the complete financial statements by simply selecting the reports from a menu. After reviewing the financial statements, the accountant can make additional adjustments and almost immediately obtain the revised reports. The software will also prepare, record, and post the closing entries.

What is a worksheet?

A worksheet is a multiple-column form used in the adjustment process and in preparing financial statements. As its name suggests, the worksheet is a working tool. Itis not a permanent accounting record; it is neither a journal nor a part of the general ledger. The worksheet is merely a device used in preparing adjusting entries and the fi nancial statements. Companies generally computerize worksheets using an electronic spreadsheet program such as Excel.

How to prepare a worksheet? What are the steps?

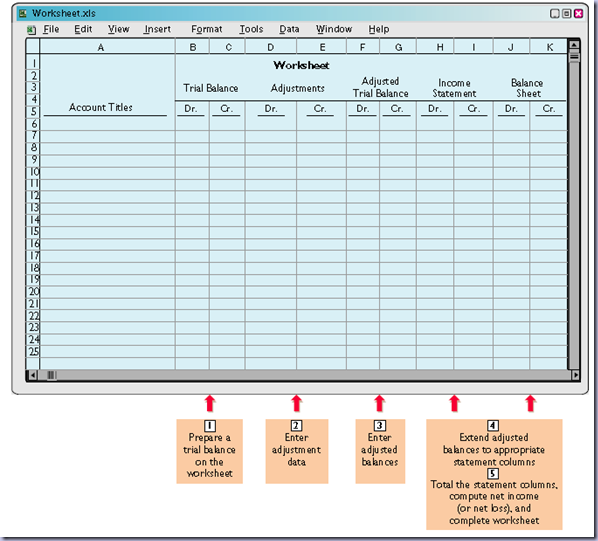

For this we will use the transactions which we used in previous chapter and prepare a worksheet. First of all Worksheet looks like the pic given below, The below pic even gives out what to be done in each part of worksheet. This whole work is normally one in a common database applications like Excel/SQL/other databases. For now we will stick to Excel as its the best and more commonly used and preferred database application.

STEP 1. PREPARE A TRIAL BALANCE ON THE WORKSHEET

Enter all ledger accounts with balances in the account titles space. Enter debit and credit amounts from the ledger in the trial balance columns. In previous chapter I gave the trail balance of the company we were working on and the same trial balance will be used here.

STEP 2. ENTER THE ADJUSTMENTS IN THE ADJUSTMENTS COLUMNS

Turn over the first transparency when using a worksheet, enter all adjustments in the adjustments columns. In entering the adjustments, use applicable trial balance accounts. If additional accounts are needed, insert them on the lines immediately below the trial balance totals. A different letter identifies the debit and credit for each adjusting entry. The term used to describe this process is keying. Companies do not journalize the adjustments until after they complete the worksheet and prepare the financial statements. The adjustments for Pioneer Advertising Agency are the same as the adjustments shown in the previous chapter. They are keyed in the adjustments columns of the worksheet as follows.

(a) Pioneer debits an additional account, Supplies Expense, $1,500 for the cost of supplies used, and credits Supplies $1,500.

(b) Pioneer debits an additional account, Insurance Expense, $50 for the insurance that has expired, and credits Prepaid Insurance $50.

(c) The company needs two additional depreciation accounts. It debits Depreciation Expense $40 for the month’s depreciation, and credits Accumulated Depreciation—Equipment $40.

(d) Pioneer debits Unearned Service Revenue $400 for services provided, and credits Service Revenue $400.

(e) Pioneer debits an additional account, Accounts Receivable, $200 for services provided but not billed, and credits Service Revenue $200.

(f) The company needs two additional accounts relating to interest. It debits Interest Expense $50 for accrued interest,

and credits Interest Payable $50.

(g) Pioneer debits Salaries and Wages Expense $1,200 for accrued salaries, and credits an additional account, Salaries and Wages Payable, $1,200.

After Pioneer has entered all the adjustments, the adjustments columns are totaled to prove their equality.

STEP 3. ENTER ADJUSTED BALANCES IN THE ADJUSTED TRIAL BALANCE COLUMNS

Pioneer determines the adjusted balance of an account by combining the amounts entered in the first four columns of the worksheet for each account. For example, the Prepaid Insurance account in the trial balance columns has a $600 debit balance and a $50 credit in the adjustments columns. The result is a $550 debit balance recorded in the adjusted trial balance columns. For each account, the amount in the adjusted trial balance columns is the balance that will appear in the ledger after journalizing and posting the adjusting entries. The balances in these columns are the same as those in the adjusted trial balance in Illustration 3-25 (page 119). After Pioneer has entered all account balances in the adjusted trial balance columns, the columns are totaled to prove their equality. If the column totals do not agree, the financial statement columns will not balance and the financial statements will be incorrect.

STEP 4. EXTEND ADJUSTED TRIAL BALANCE AMOUNTS TO APPROPRIATE FINANCIAL STATEMENT COLUMNS

The fourth step is to extend adjusted trial balance amounts to the income statement and balance sheet columns of the worksheet. Pioneer enters balance sheet accounts in the appropriate balance sheet debit and credit columns. For instance, it enters Cash in the balance sheet debit column, and Notes Payable in the credit column. Pioneer extends Accumulated Depreciation—Equipment to the balance sheet credit column; the reason is that accumulated depreciation is a contra-asset account with a credit balance. Because the worksheet does not have columns for the owner’s equity statement, Pioneer extends the balance in owner’s capital to the balance sheet credit column. In addition, it extends the balance in owner’s drawings to the balance sheet debit column because it is an owner’s equity account with a debit balance.

STEP 5. TOTAL THE STATEMENT COLUMNS, COMPUTE THE NET INCOME (OR NET LOSS), AND COMPLETE THE WORKSHEET

The company now must totaleach of the financial statement columns. The net income or loss for the period is the difference between the totals of the two income statement columns. If total credits exceed total debits, the result is net income. In such a case, as shown in the working smple below, the company inserts the words “Net Income” in the account titles space. It then enters the amount in the income statement debit column and the balance sheet credit column. The debit amount balances the income statement columns; the credit amount balances the balance sheet columns. In addition, the credit in the balance sheet column indicates the increase in owner’s equity resulting from net income. What if total debits in the income statement columns exceed total credits? In that case, the company has a net loss. It enters the amount of the net loss in the income statement credit column and the balance sheet debit column. After entering the net income or net loss, the company determines new column totals.

The totals shown in the debit and credit income statement columns will and must match. So will the totals shown in the debit and credit balance sheet columns. If either the income statement columns or the balance sheet columns are not equal after the net income or net loss has been entered, there is an error in the worksheet. The Sample below gives the complete worksheet done on Excel. After doing all the steps in your worksheet, then compare it with the worksheet done by me to look out for errors in your worksheet. Download my worksheet as the frame in below is not enough to show the whole excel sheet and so the HTML framing automatically divided the excel sheet randomly which confuses anyone for sure. So, download it and then view it.

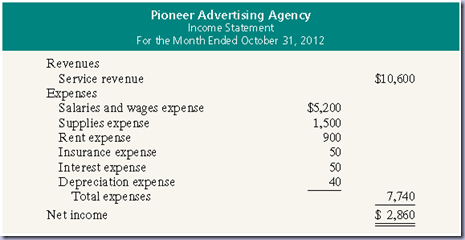

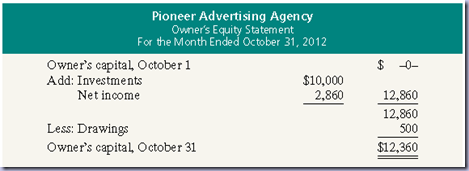

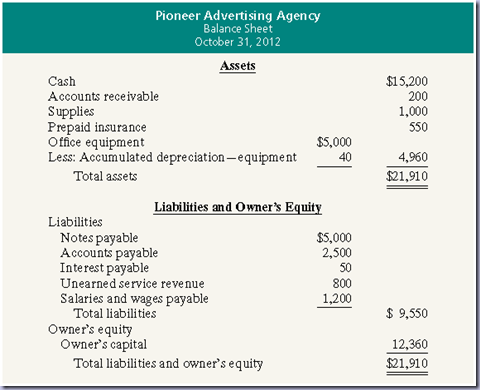

Using a worksheet, companies can prepare financial statements before they journalize and post adjusting entries. However, the completed worksheet is not a substitute for formal financial statements. The format of the data in the financial statement columns of the worksheet is not the same as the format of the financial statements. A worksheet is essentially a working tool of the accountant; companies do not distribute it to management and other parties.

What is 'Closing the Books' in Accounting?

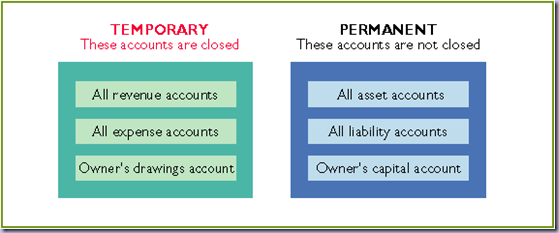

At the end of the accounting period, the company makes the accounts ready for the next period. This is called closing the books. In closing the books, the company distinguishes between temporary and permanent accounts. Temporary accounts relate only to a given accounting period. They include all income statement accounts and the owner’s drawings account. The company closes all temporary accounts at the end of the period. In contrast, permanent accounts relate to one or more future accounting periods. They consist of all balance sheet accounts, including the owner’s capital account. Permanent accounts are not closed from period to period. Instead, the company carries forward the balances of permanent accounts into the next accounting period.

How to prepare closing entries??

At the end of the accounting period, the company transfers temporary account balances to the permanent owner’s equity account, Owner’s Capital, by means of 'closing entries'.Here 'Closing Entriess' is a procedure.

Closing Entries are simply the last transaction which are taken from temporary accounts into Owner's Capital Accounts in such a way that these entries/transaction in ledger will define that a period is closed and new period had started. As money in temporary accounts will be shifted as part of 'Closing Entries' it produces a Zero-Balance in temporary Accounts. Journalizing and posting these closing entries to ledger is a compulsory step for each accounting cycle to significantly identify the period-end. 'Closing Entries' are done only after financial statements are prepared.

Companies record closing entries in the general journal. A center caption, Closing Entries, inserted in the journal between the last adjusting entry and the first closing entry, identifies these entries. Then the company posts the closing entries to the ledger accounts.

What are the steps in Closing Entries?

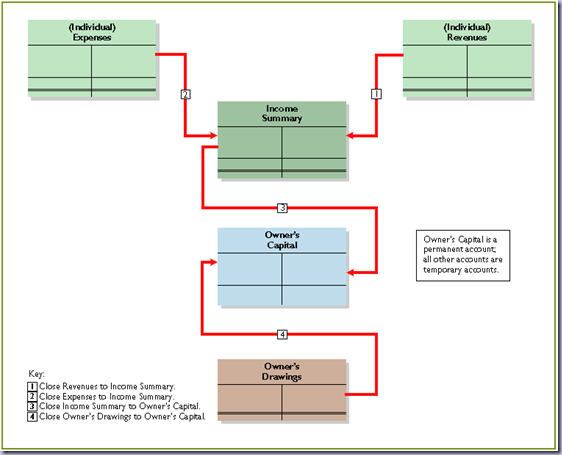

Companies generally prepare closing entries directly from the adjusted balances in the ledger. They could prepare separate closing entries for each nominal account, but the following four entries accomplish the desired result more efficiently:

Companies generally prepare closing entries directly from the adjusted balances in the ledger. They could prepare separate closing entries for each nominal account, but the following four entries accomplish the desired result more efficiently:

1. Debit each revenue account for its balance, and credit Income Summary for total revenues.

2. Debit Income Summary for total expenses, and credit each expense account for its balance.

3. Debit Income Summary and credit Owner’s Capital for the amount of net income.

4. Debit Owner’s Capital for the balance in the Owner’s Drawings account, andcredit Owner’s Drawings for the same amount.

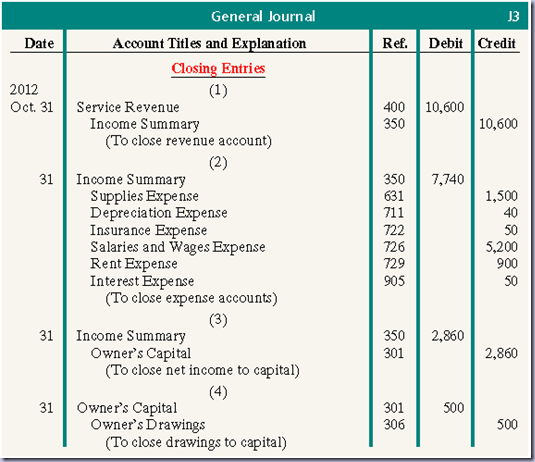

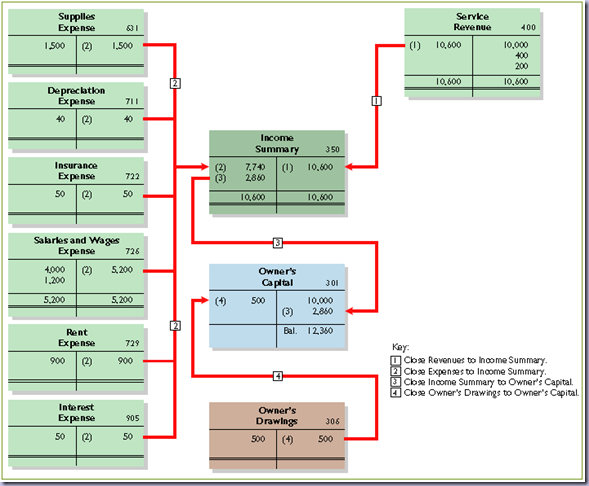

Now the Journal for CLosing Entries will be as shown below, Lets consider that Pioneer Advertising Agency will do closing-entries for each mont unlike normally closing-entries will be done with a long-gap of atleast 6 months. Then, as per the transactions that are carried out upto now in Pioneer Advertising Agency, the closing-entries will be journalised as below,

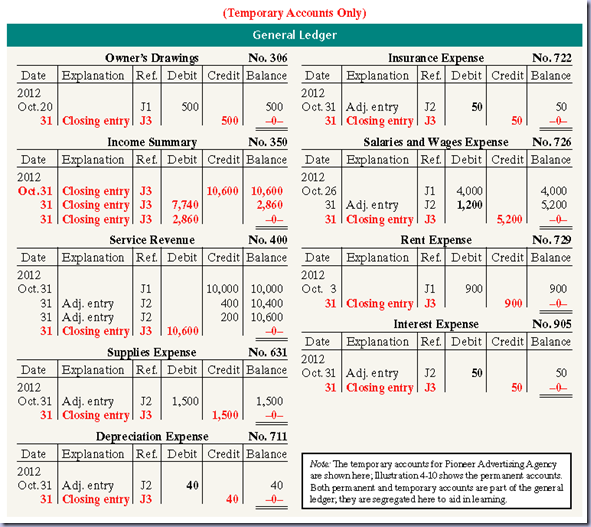

In the same way as per the References as in each transaction of closing-entries in above journal entry, the transactions will be posted into ledger

What is Post-Closing trial balance? Prepare the Post-closing trial balance for Pioneer Advertising Agency as closing-entries is done in previous question?

After Pioneer has journalized and posted all closing entries as in previous question, it prepares another trial balance, called a post-closing trial balance, from the ledger. The postclosing trial balance lists permanent accounts and their balances after journalizing and posting of closing entries. The purpose of the post-closing trial balance is to prove the equality of the permanent account balances carried forward into the next accounting period. Since all temporary accounts will have zero balances, post-closing trial balance will contain only permanent—balance sheet— accounts.

The post-closing trial balance for Pioneer Advertising is shown below, check all the accounts carefully, this post-closing trial balance is only on permanent accounts only as temporary accounts are with zero-balance by the time this is prepared due to closing-entries.

Now, compare the above General Ledger with the steps of closing-entries (vs) journalized closing-entries (vs) post-trial balance shown above. The remaining accounts in the general ledger are temporary accounts After Pioneer correctly posts the closing entries, each temporary account has a zero balance. These accounts are double-ruled to finalize the closing

process as shown below.

What are the methods of error correction for falty transactions?

There are 2 methods of Error correction

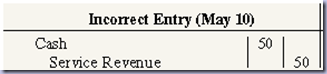

1)CORRECTING ENTRY: Correcting Entry is the concept where a transaction is done between the wrong accounts. Lets just say on May 10, Mercato Co. journalized and posted a $50 cash collection on account from a customer as a debit to Cash $50 and a credit to Service Revenue $50. The company discovered the error on May 20, when the customer paid the remaining balance in full. So transactions look like which is actually an incorrect transaction.

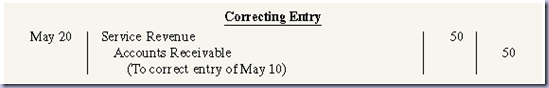

In this perspective, on May 20, they discovered that Credit Account must be 'Accounts Receivable' but not the 'ervice Revenue'. In this scenario, to do a CORRECTING ENTRY they will make other transaction on MAy 20 whic looks like ,

2) REVERSING ENTRY: Reversing Entry is completely different to the above method. Here, the whole transaction is reversed meansfor each incorrect trasaction, they will make opposite transaction between the same accounts in the incorrect trasaction so that the amount goes back to the original account. And then they make the correct transacation. This will surely result in more entres and postings because, first of all the transaction must be reversed and if the transacion includes many accounts then many postings in ledger takes place and then the correct transaction must be journalized and posted into ledger. This might look awkward in broad sense but SAP FICO module follows this method of error correction.

What is Classical Balance Sheet?

The balance sheet presents a snapshot of a company’s financial position at a point in time. To improve users’ understanding of a company’s financial position, companies often use a classified balance sheet. A classified balance sheet groups together similar assets and similar liabilities, using a number of standard classifications and sections. Standard classifications and sections are the different types of assets n the company, different types of liabilities and owner's Equity.

What are Current Assets?

Current assets are assets that a company expects to convert to cash or use up within one year or its operating cycle, whichever is longer. In Illustration 4-18, Franklin Company had current assets of $22,100. For most businesses the cutoff for classification as current assets is one year from the balance sheet date. For example, accounts receivable are current assets because the company will collect them and convert them to cash within one year. Supplies is a current asset because the company expects to use it up in operations within one year.

What are long-term investments?

Long-term investments are generally, (1) investments in stocks and bonds of other companies that are normally held for many years, and (2) long-term assets such as land or buildings that a company is not currently using in its operating activities.

What is Property, plant and Equipment?

Property, plant, and equipment are assets with relatively long useful lives that a company is currently using in operating the business. This category (sometimes called fixed assets) includes land, buildings, machinery and equipment, delivery

equipment, and furniture.

equipment, and furniture.

Depreciation is the practice of allocating the cost of assets to a number of years. Companies do this by systematically assigning a portion of an asset’s cost as an expense each year (rather than creating an expense for the full purchase price in the year of purchase). The assets that the company depreciates are reported on the balance sheet at cost less accumulated depreciation. The accumulated depreciation account shows the total amount of depreciation the company paid as expense thus far in the asset’s life.

What are Intangiable Assets?

Many companies have long-lived assets that do not have physical substance yet often are very valuable. We call these assets intangible assets. One common intangible asset is goodwill. Others include patents, copyrights, and trademarks or trade names that give the company exclusive right of use for a specifi ed period of time.

What are Current Liabilities?

In the liabilities and owners’ equity section of the balance sheet, the first grouping is current liabilities. Current liabilities are obligations that the company is to pay within the coming year or its operating cycle, whichever is longer. Common examples are accounts payable, wages payable, bank loans payable, interest payable, and taxes payable. Also included as current liabilities are current maturities of long-term obligations—payments to be made within the next year on long-term obligations.

Within the current liabilities section, companies usually list notes payable first, followed by accounts payable. Other items then follow in the order of their magnitude. In your homework, you should present notes payable fi rst, followed by accounts payable, and then other liabilities in order of magnitude.

What are Long-term Liabilities?

Long-term liabilities are obligations that a company expects to pay after one year. Liabilities in this category include bonds payable, mortgages payable, long-term notes payable, lease liabilities, and pension liabilities. Many companies report longterm debt maturing after one year as a single amount in the balance sheet and show the details of the debt in notes that accompany the financial statements.